Aperture Health, Inc. (OTCMKTS:APRE)’s Pump Fails

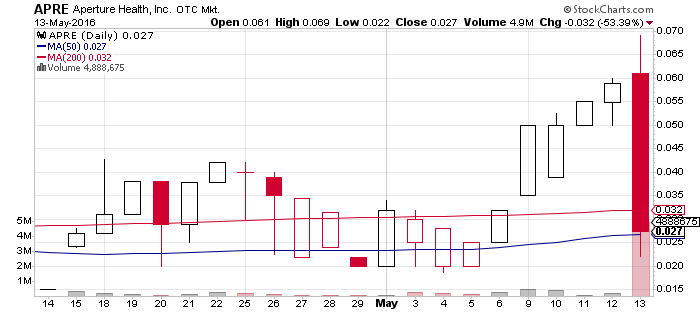

Aperture Health, Inc. (OTCMKTS:APRE) managed to climb almost all the way to $0.06 on the efforts of paid pumpers by the time Thursday came along – and promptly lost all its gains on Friday.

Aperture Health, Inc. (OTCMKTS:APRE) managed to climb almost all the way to $0.06 on the efforts of paid pumpers by the time Thursday came along – and promptly lost all its gains on Friday.

Once you take a closer look at it, this seems to be a classic OTC markets pump job. Even one cursory glance at the company’s latest financial report, for the quarter ended Dec. 2015, all but confirms this suspicion:

- Cash – $1 thousand

- Total current assets – $ 43 thousand

- Total current liabilities – $5 million

- NO REVENUES

- Net Loss – $670 thousand

For a while Blue Horseshoe Stocks’s touts, in combination with APRE‘s own torrent of boasts and PR may have convinced investors that this stock is the best thing since sliced bread, but touts can only do so much. Sooner or later reality catches up with companies that have outgrown their actual worth, and the results are never pretty.

That’s probably what happened to APRE this last Friday. Either that, or that $1 million worth of debt that the company has had outstanding for more than seven years, which convert into shares of its common stock at undisclosed rates, have finally taken their toll on investor value.

Truth be told, it wouldn’t really be all that surprising if that was indeed the case, seeing as how the company has already had to perform two monstrous reverse splits to keep its stock liquid in spite of all of its issuance shenanignans.

So while we can’t really be absolutely sure what took the ticker down in yesterday’s trading, one thing is fairly certain – APRE is as dubious a company as they get on the OTC Markets’ pinksheets tier. Many investors have already been burned in yesterday’s crash.

With this in mind – let the buyer beware.

With this in mind – let the buyer beware.