Cherubim Interests Inc (OTCMKTS:CHIT) Keeps Investors on Their Toes

Cherubim Interests Inc (OTCMKTS:CHIT) has given traders a rather wild ride over the last month or so. It all started at the beginning of September when Damn Good Penny Picks as well as a few other promotional outfits received some money and in exchange, they tried to pump up the share price. They made a rather big hash of it.

Cherubim Interests Inc (OTCMKTS:CHIT) has given traders a rather wild ride over the last month or so. It all started at the beginning of September when Damn Good Penny Picks as well as a few other promotional outfits received some money and in exchange, they tried to pump up the share price. They made a rather big hash of it.

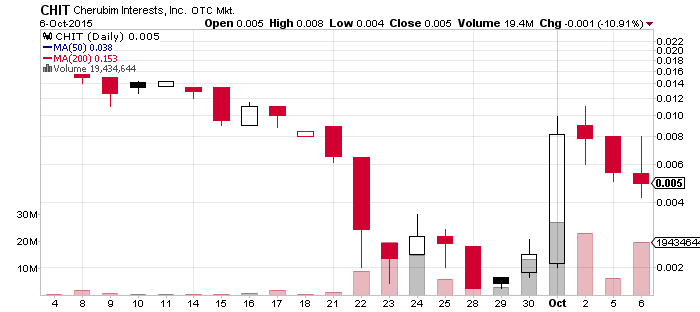

Instead of going up, CHIT nosedived and wiped out a whopping 46% of its value in a single day, stopping at just over $0.02 per share. The crash was so painful that even the pumpers felt a little embarrassed. They decided that their best strategy is to tiptoe their way away from CHIT and pretend that nothing has happened.

In their absence, the volumes all but disappeared and the ticker took a few additional blows which eventually brought it down to less than $0.01 on September 18. On October 1, CHIT attempted another run. The pumpers were involved once again and this time, they were a bit more successful. Unfortunately, the campaign only lasted for a day and CHIT‘s performance over the last few sessions clearly shows that on its own, the ticker is somewhat reluctant to stay afloat.

Last week, in a matter of two days, it dropped from around $0.008 to $0.0055 and yesterday, after losing another tenth of its value, it stopped at $0.0049. About ten minutes after today’s opening bell, the stock is another 15% down at $0.0042. Time to see why CHIT has been using so much red paint over the last few days.

The press releases certainly make all the right noises. CHIT recently launched a revamped version of their website and on Monday, they announced that they, along with a new partner of theirs, will try to develop a controlled environment agriculture technology that will be perfect for marijuana growers.

The only problem is, developing any sort of technology requires money and money is something CHIT simply don’t have. At least that’s what the latest 10-Q says:

- NO assets whatsoever

- current liabilities: $2,337,259

- NO revenue

- quarterly net loss: $238,727

With a financial statement as dreadful as this one, surging past the $0.01 per share mark again will be nothing more than a distant dream. Even if the management team manage to fix the company’s financial situation a bit, the dilution might still keep the ticker grounded.

As we mentioned in our previous articles, CHIT issued quite a lot of shares after the reverse split in June which means that on July 20, the O/S count was sitting at more than 58 million. Eight days later, it was hovering around 77 million, but the share printing was just getting started. By the end of August, the number of issued and outstanding shares had grown to more than 127 million.

CHIT‘s fiscal year end is August 31 which means that we’ll need to wait for about a month before we can see who and why got the newly printed stock. We should probably note, however, that a few months ago, the company had some outstanding notes that were convertible into shares at discounts ranging from 42% to 45%.