How High Will PF Hospitality Group Inc. (OTCMKTS:PFHS) Rise?

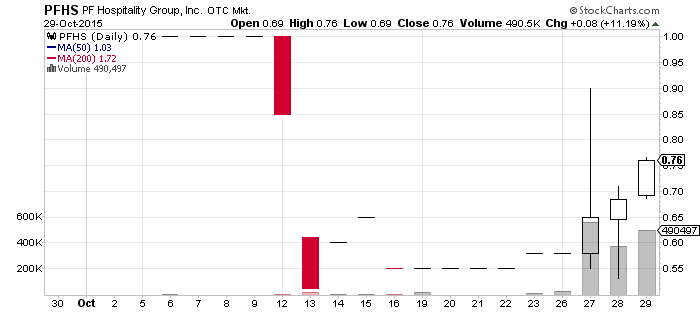

PF Hospitality Group Inc. (OTCMKTS:PFHS) added another 11.19% to its market value yesterday. Why?

PF Hospitality Group Inc. (OTCMKTS:PFHS) added another 11.19% to its market value yesterday. Why?

Simply put, the company is riding a wave of hype right now, and the media seems to be happy to perpetuate that for the moment. Just minutes ago, CNN Money posted its press release, and MarketWatch keeps mentioning it in its “due diligence reports”. Add that to the company’s own boastful announcements that keep popping up and it should be pretty clear why investors are excited about PFHS. The fact that the information that said press releases carry lately is rather meaningless doesn’t seem to bother investors much.

And that would be fine, by the standards of the OTC Markets at least, if it wasn’t for the other red flags that a bit of due diligence on PFHS reveals.

One such serious red flag can be found in the company’s financials, which are hardly inspiring:

- cash – $82 thousand

- current assets – $93 thousand

- current liabilities – $1.1 million

- nine-month revenue – $273 thousand

- nine-month net loss – $160 thousand

However, there’s an even more immediate threat to investor value to be found in that filing. Namely – the toxic debt that the company has accumulated over the years.

As its filings can attest, PFHS owes a great deal of money to noteholders, who can transform it into shares of the company’s common stock “…At a conversion price equal to 65% of the lowest traded price of its common stock for the 20 trading days prior to each conversion date subject to adjustment”.

And this is hardly the only dilution shenanigans in PFHS‘s bag of tricks. On August 25, 2015 more than $65 thousand in convertible notes was converted into 40MILLION shares of common stock, at an average conversion rate of a mere $0.0016 per share. This happened less than three months after a reverse split.

And this is hardly the only dilution shenanigans in PFHS‘s bag of tricks. On August 25, 2015 more than $65 thousand in convertible notes was converted into 40MILLION shares of common stock, at an average conversion rate of a mere $0.0016 per share. This happened less than three months after a reverse split.

Those facts hint that investors should probably pay more close attention tread lightly when dealing with PFHS stock.