Provison Holding Inc (OTCMKTS:PVHO)’s New PR Gets Investors Excited

tags: PVHO

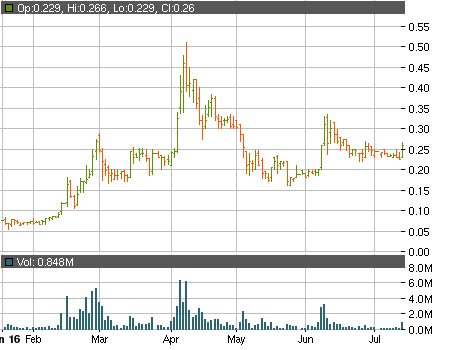

After a slow but steady slide that spanned several weeks yesterday the stock of Provison Holding Inc (OTCMKTS:PVHO) finally managed to reverse its direction. The ticker surged upwards as investors showed renewed interest in the company – after nearly 850 thousand shares changed hands during the session PVHO‘s stock reached a close at 26 cents per share for a daily gain of 15%.

As is usually the case with PVHO the catalyst for the positive session was a new PR. Apparently a major pharmaceutical company, that remained unnamed in the press release, will be promoting its consumer health care brands on PVHO‘s 3D Savings Center kiosks. Such encouraging announcements have indeed been able to capture the attention of the market but unfortunately the hype usually starts to dissipate rather quickly. Will this time be any different?

Compared to many of the other pennystock ventures PVHO‘s financial state is actually not that bad. The company finished the first quarter of the year with:

• $2.01 million cash

• $3.97 million current assets

• $7.97 million current liabilities

• $2.02 million revenues

• $913 thousand net loss

Getting overly excited carries a lot of risk, though. In order to raise capital for their operations PVHO sold convertible notes totaling $4.1 million during the nine-month period ended March 31, 2015. These notes can be turned into common shares at $0.10, which is over 60% lower than yesterday’s closing price. The subsequent events section of the quarterly report revealed that in April 4.3 million shares had already been issued as debt conversion.

The latest 8-K filing also raises some concerns. On June 30 PVHO had managed to exchange a note with principal balance and accrued interest totaling $264 thousand convertible at $0.03 per share for new notes with a principal balance of over a million and a conversion price of $0.10. The holders of the notes will also receive warrants with an exercise price of $0.15. The conversion price may now be higher but it still represents a steep discount to the market price. From the 8-K filing investors also learned that the amount of authorized shares had been increased – from 200 million to 300 million authorized shares.

The fact that PVHO has been target by paid pumps on quite a few occasions shouldn’t be overlooked. The latest alert email touting the stock of the company came just a couple of days ago on July 11. It was send by the newsletter StockBeast for a disclosed compensation of $22,500. The pumper has been hired for the period between July 11 and August 10 so even more emails should be expected. This is not the first time StockBeast has been trying to generate as much artificial hype around the stock as possible – for its previous services it has received a total of $85 thousand.

In early trading today PVHO slumped downwards but is currently trading over 1% in the green at $0.263.