Vape Holdings Inc (OTCMKTS:VAPE) Surges On Massive Volume

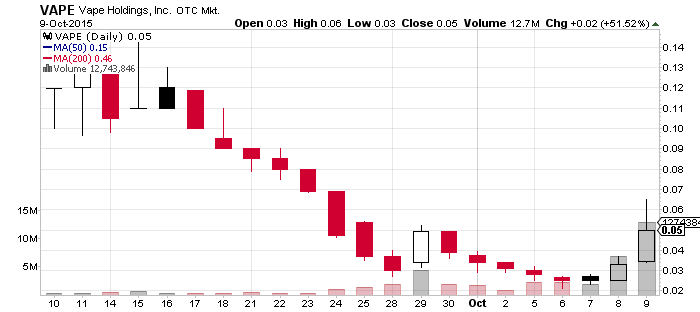

Vape Holdings Inc (OTCMKTS:VAPE) share prices reached a nickel on Friday, after nearly 13 million of the company’s shares of common stock changed hands.

Vape Holdings Inc (OTCMKTS:VAPE) share prices reached a nickel on Friday, after nearly 13 million of the company’s shares of common stock changed hands.

The buying frenzy was made possibly by the corporate update that VAPE published. Investors were more than happy to jump on the ticker once that hit the web – but will they regret getting on the hype train before long?

VAPE is hardly the most stable of tickers, even by the extremely lax standards of the OTC Markets – and there are a couple of very good reasons for why that is so. For starters, its financials look less than impressive, even by the aforementioned low standards:

- Cash – $134 thousand

- Current assets – $818 thousand

- Current liabilities – $1.3 million

- Quarterly revenues – $282 thousand

- Quarterly net loss – $436 thousand

And that’s not even the biggest threat to investor value to be found when looking into the company’s affairs. According to its filings, VAPE currently has upwards of $1.6 million worth of convertible notes, that could be turned into stock at various discounts and flood the market, plunging the ticker into the depths at any point in time.

The fact that since the end of August $227 thousand worth of convertible debt has been turned into more than 5.1 million shares is further proof that investors should be on their toes around VAPE. As of September 29 the company had 18.3 MILLION shares outstanding – and since its shares authorized are 1 BILLION, there’s nothing to stop noteholders from drowning investor value in dilution at any time they see fit.

Thus, while VAPE‘s current volatility does certainly present an opportunity to make a quick profit, if considered in the context the company’s other circumstances, said volatility turns out to be nothing less than a double edged sword.

Thus, while VAPE‘s current volatility does certainly present an opportunity to make a quick profit, if considered in the context the company’s other circumstances, said volatility turns out to be nothing less than a double edged sword.